Let’s face it, securing investment for a regenerative community project can be challenging.

People building villages for the future often oppose the inequity and extraction caused by capital. Here we are, needing to sprint to regenerate our planet’s resources, all for the pursuit of money.

Ultimately, money is going to be spent, and it should go towards the projects that best steward the earth and challenge our broken social paradigms.

In my article, How to Fund A Regenerative Village, I review ways to fund your village, some of which don’t require actual funds. Let’s hone in on the specific scenario of pitching your community project to people with the agency to help you financially.

Whether you’re pitching to an investor-owner (someone who will live in the community you build), a wealth management investment fund, or even a family member curious to support your project, there are things you need to know.

This post explores strategies and hacks for effectively preparing and pitching your regenerative community project. At the end, I offer a checklist for pitching your project.

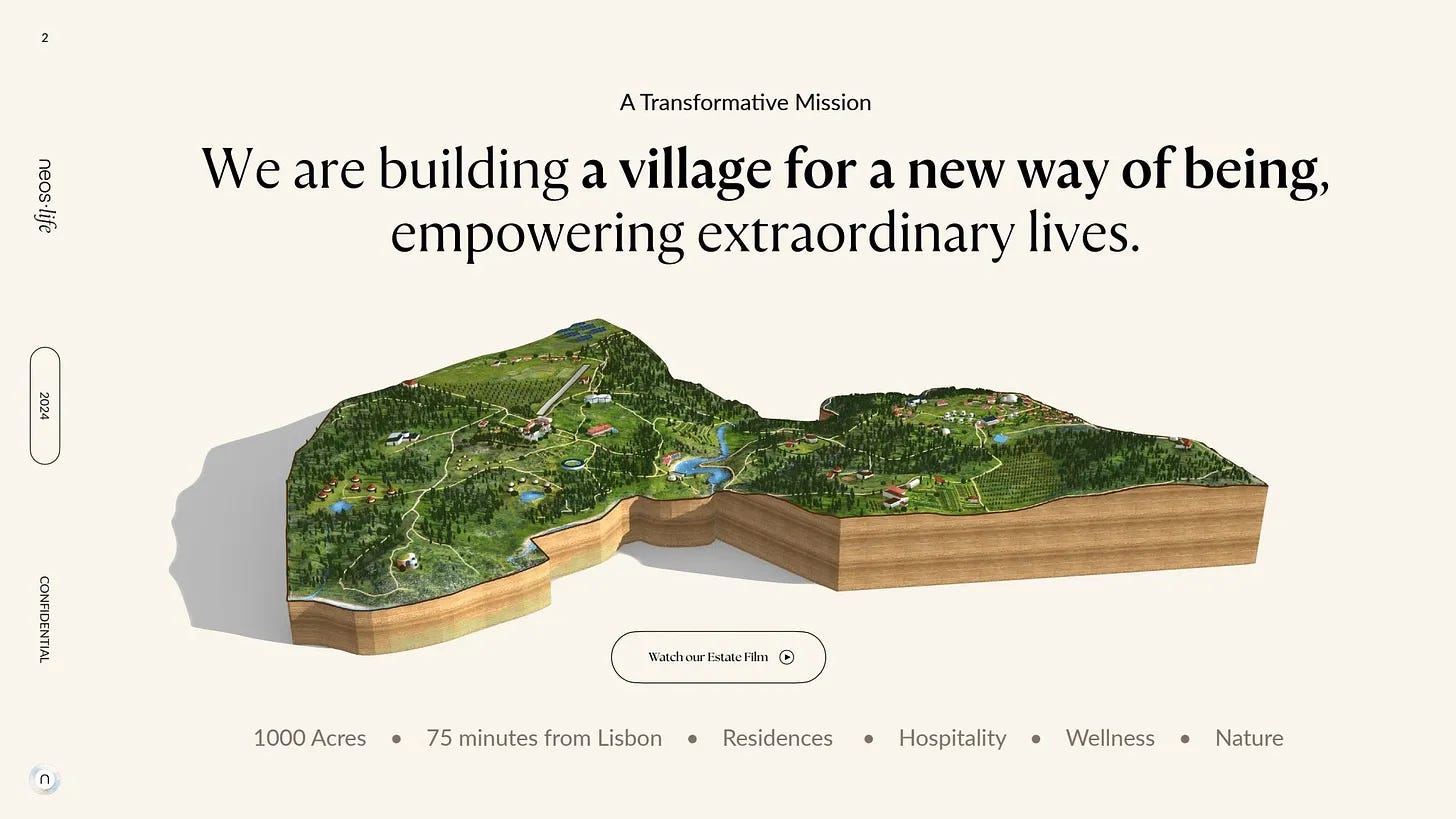

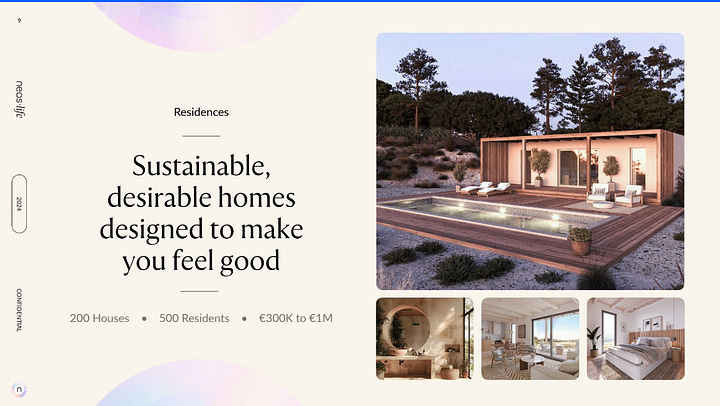

Case Study : neos·life in Portugal

This article was inspired by

and their recent call to action to secure a €5M bridge loan to acquire their intended property in Portugal. The seller was growing impatient entertaining an offer from someone they initially brought on as a partner in the project.Read their CTA newsletter for inspiration on how to craft a compelling pitch that speaks to both general audiences and private investors. Neos·life shares a very clear vision for their village in their investment deck. While I’ve seen a truckload of village pitches, I’m going to be using their pitch as a case study for the rest of the article.

1. Clarify Your Vision and Value Proposition

Before anything else, you need a clearly defined vision for your community project. Investors are drawn to projects that are focused and mission-driven, so it’s crucial to communicate how yours will address specific challenges or offer a unique value in the market.

Your main goal here is to help investors understand the potential and value of the project while addressing their expectations and priorities.

2. Know Your Audience

Investors, especially those unfamiliar with regenerative principles, will likely need a compelling case that combines financial viability with a solid vision for impact. Tailoring your pitch to the type of investor you’re approaching can make all the difference.

Tips for Audience-Specific Pitches:

Identify core motivations: Understand whether your investor is more financially driven, interested in impact, or looking for alternative exchanges. If they’re new to the regenerative field, bridge any gaps by illustrating how sustainability aligns with long-term returns.

Customize language: Validated in a recent query I made on LinkedIn,

(Regen Earth Studio) recommends tailoring language to your investment audience. Use terms that resonate with the investor’s background and priorities. I’ll talk more about this in my next article where I show how I created multiple decks based on who the audience was.Use comparable examples: Showcase examples of successful regenerative projects that have delivered returns, such as Serenbe in Georgia, USA, or growing industries that overlap your village project. This helps demonstrate that there’s a demand for such communities.

What neos·life did:

They identify Market Trends early on in their pitch deck, to speak clearly to investors that there is substantial evidence that this project will work.

Tailored language: “Good-for-You is Good for Business” was a brilliant way to showcase how the wellness industry is performing and speak directly to sharp business minds.

3. Make Financial Returns Clear as Day

Even with a strong vision, investors need to see that your project is financially viable. A clear business model shows that you have planned for profitability and can sustain the community in the long run.

What neos·life did:

Laid out returns in a straightforward way, such as “20% p.a. interest rate meaning you will get your money plus a healthy return back in six months.” and “we give you 1% of equity for every €1M lent, so you will keep a share in neos·life even after you got your money back.“

Didn’t ask for indefinite funds, gave a clear, reasonable timeline of 6 months.

Made it clear the different tiers of investment available, which made the goal of €5m feel less daunting: “You are one of 3,500 subscribers of this newsletter...If each of you lent €3,000...or if 10% of you 1,300 lent €30,000 for six months…or if 1%, 13 of you, lent us €300,000 for six months, we would be all set!“

Read this deceptively simple paragraph:

Many projects do not lay out these terms so simply, and not all projects can or should offer such quick returns. This is one benefit of acquiring turnkey properties to start turnaround on your village sooner.

4. Show Your Financial Projections and Risk Mitigation

Investors need to understand not only how they’ll see returns but also what steps you’re taking to minimize risks.

Tips for Presenting Financials and Risks:

Prepare realistic projections: Show a well-researched and realistic forecast of revenues, expenses, and profit margins. Use comparable projects as benchmarks where possible, and create some juicy graphs to show the projections visually.

Emphasize risk management: Address common risks, like regulatory changes, market volatility, or environmental hazards, and share your mitigation plans. For instance, highlight sustainable building practices, insurance policies, and your ability to adapt.

Illustrate exit options: Even if the investor intends to stay involved long-term, it’s useful to discuss options for a potential exit, such as resale opportunities or community buy-back programs.

What neos·life did:

Outlined clear risk management stipulations:

“This land serves as your security, should we not be able to repay you in six months.”

“If for reasons beyond our control, we can’t refinance with a bank or receive other investment and we therefore cannot pay you back in six months, we will initiate the sale of the property…In this case, the land including all the work we have done will be sold and you repaid. With the planning permission in hand, the land is worth many times what you invested.“

Whether the project succeeds or fails as an investor, it feels like you still win.

5. Emphasize Regenerative and Sustainable Elements (in the least woo-woo way possible)

Investors are often drawn to unique selling points. Highlighting the regenerative elements of your project can be a powerful way to set it apart and appeal to environmentally conscious investors. But you want to be mindful that your “new earth” language doesn’t sound too hippie-dippie to straight-laced investors.

I’m a die-hard regen, but I’ve read enough of these types of pitches that I’m allergic to them.

Tips to emphasize sustainability:

Present measurable impact goals: If you have specific goals for carbon reduction, waste diversion, or biodiversity improvement, share these. Investors interested in impact will want to see measurable outcomes.

Explain benefits in dollar terms: Quantify the cost savings that sustainable features provide over time, such as reduced utility costs from solar energy or improved health outcomes due to eco-friendly designs.

What neos·life did:

In their investment deck at least, the specific regenerative goals or benefits are not illustrated. There is a general mention of sustainability, so it would be worthwhile to include more metrics on the social-ecological-economic benefits they create locally in order for them to secure government/impact funding alongside private investment.

6. Craft a Visual and Engaging Pitch Deck

People’s first knee jerk is to create a pitch deck for their community. Some of the common issues I see with these decks is that it just represents an idea, not a plan. My 5-month old kitten gets plenty of bold ideas, but her execution still flops. Investors are more likely to engage with a plan.

Key elements of an engaging pitch deck that people often miss (that neos·life included):

Community renders and site layouts

Infographics and impact metrics

Projections & Market Research Graphs

Development Plan and Timeline

Existing Traction and Accomplishments

8. Create a Narrative

Stories resonate, and one of the strongest assets of a regenerative community project is its focus on people. Help investors see the “big picture” impact of your project on residents, the local community, and future generations.

Take this into special account, because “investors” can also include government grants from municipalities, which have been instrumental in the creation of villages like Traditional Dream Factory. And, there are just way too many projects that completely ignore this aspect.

What neos·life did:

Present tense, action-oriented verbiage

Focused on the trends in wellness and creating holistic ways of living

Could have included more about project’s presence in the local region, what relationships it intends to cultivate, what local economy it will support (or compete with).

Overall, I was impressed with their pitch. I thought it demonstrated mad skill crafting a narrative that simply electrifies people to want to be involved, even if it was just the person who forwarded me their pitch asking if I knew anyone who wanted to support. That’s the kind of crowd-mobilized word of mouth action you want to inspire in people.

For my paid subscribers, I’ve put together a checklist of what to include in your pitch to investors, with bonus “Common Questions Investors May Ask“ section. Upgrade today to access.

Thank you for being a Terrenity reader!

Keep reading with a 7-day free trial

Subscribe to Terrenity to keep reading this post and get 7 days of free access to the full post archives.